Should the home’s value is reduce than the purchase cost, consumers might be able to back out in the transaction.

When the home appraisal is lower than the acquisition value, your lender may not approve the bank loan. In case you’re refinancing your mortgage loan, the appraisal decides your LTV, which influences your new desire rate.

DISCLAIMER: The info and valuations are furnished as is without the need of warranty or ensure of any kind, both express or implied, such as without limitation, any warranties of merchantability or Conditioning for a selected reason.

Thanks! We've gained your information. We'll be subsequent up right away to put with each other a home finance loan estimate with you. ×

Ask for thoughts: To be a homeowner, you may not generally see things which could be wrong as part of your home. Ask for out of doors viewpoints from relatives or buddies who will identify any troubles they see as part of your house. They might recognize insignificant advancements you can also make to help increase your home’s benefit.

That has a home inspection, the inspector will try to look for any problems like outlets not Operating correctly, exterior and interior harm, and HVAC systems, amongst other issues. When appraisers determine the home’s benefit, a home inspector will check for problems and safety problems within the home.

Chris Jennings is formally a writer and editor with much more than 7 a long time of expertise in the non-public finance and home finance loan Room. He enjoys simplifying sophisticated home loan subject areas for initially-time homebuyers and homeowners alike. His work has been featur...

The moment the client and seller have Every signed the deal, the customer’s real estate property agent contacts the lender, who then books a certified home appraiser To judge the property. In order that the appraisal is goal, this appraiser has to be a third party without having loyalty or ties of any variety for the lender, buyer, or vendor.

Worst circumstance, you may have to walk faraway from the home sale. There are many extra strategies to bear in mind:

Home appraisal contingencies are advisable but it surely may well not always be the correct preference – particularly read more in case you’re obtaining the home in all-income or it’s a vendor’s market.

Chris Jennings is formally a author and editor with more than seven yrs of experience in the personal finance and home finance loan space. He enjoys simplifying intricate mortgage topics for 1st-time homebuyers and homeowners alike. His do the job continues to be featur...

An appraisal is usually a significant Element of the homebuying system. In the event your home appraisal is available in decreased than predicted, it might cost you cash and hold off — or maybe derail — your entire transaction. Listed here we delve into what an appraisal is, why it’s essential and how it may possibly impression your home financial loan.

Sellers, prospective buyers, and refinancers need to all be accustomed to appraisals And the way they slot in the homebuying/marketing or mortgage loan procedure. As soon as the appraisal approach is finished, there are a handful of scenarios that buyers and sellers can be expecting.

When purchasing or marketing a home, an appraisal verifies the sale cost of the home is in line with honest industry price. This makes certain the homebuyer doesn’t pay back greater than the home is really worth, as well as the home finance loan lender doesn’t lend much more than it is really worth.

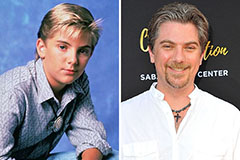

Mason Gamble Then & Now!

Mason Gamble Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!